Improvement Measures for Foreign Exchange Market Structure

Korea’s improvement measures for foreign exchange market structure,

aiming to enhance market accessibility in line with global standards

Background

Korea’s foreign exchange (FX) market has been maintaining its closed and restrictive structure for several decades. However, such structure has been a drag on the growth of the FX market and hindered market stability. Moreover, low accessibility of the FX market has made KRW-denominated assets less attractive and undermined the overall development of the capital market and the financial industry.

Various market participants have expressed three main difficulties as follows.

1) Deliverable Korean Won is traded only in the onshore FX market.

2) However, Foreign Financial Institutions (FIs) are not allowed to directly participate in the onshore interbank FX market.

3) Trading hours in the onshore FX market are restricted.

Against this backdrop, the Korean government strives to raise the accessibility of the onshore FX market in line with global standards by transforming the onshore FX market structure to be more open and competitive. To this end, the following improvement measures were announced in February 7, 2023.

Improvement Measures in Detail

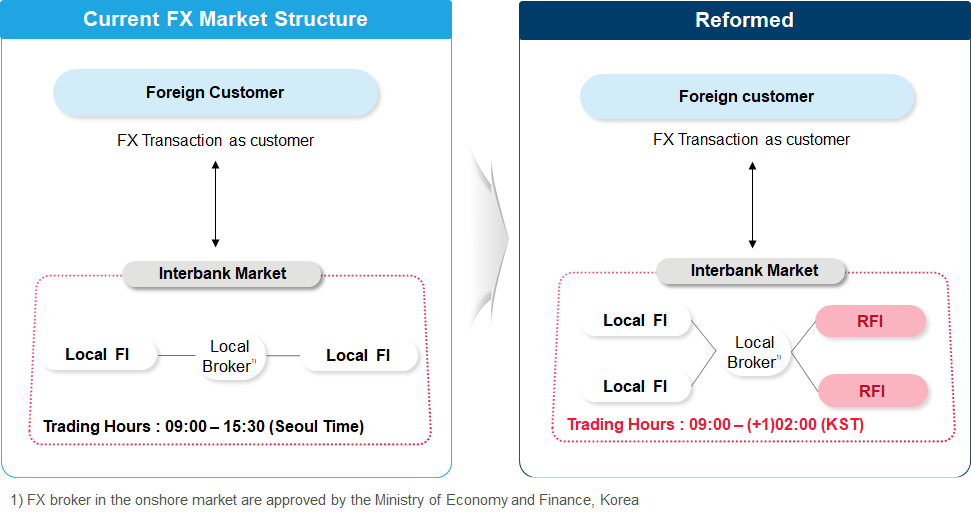

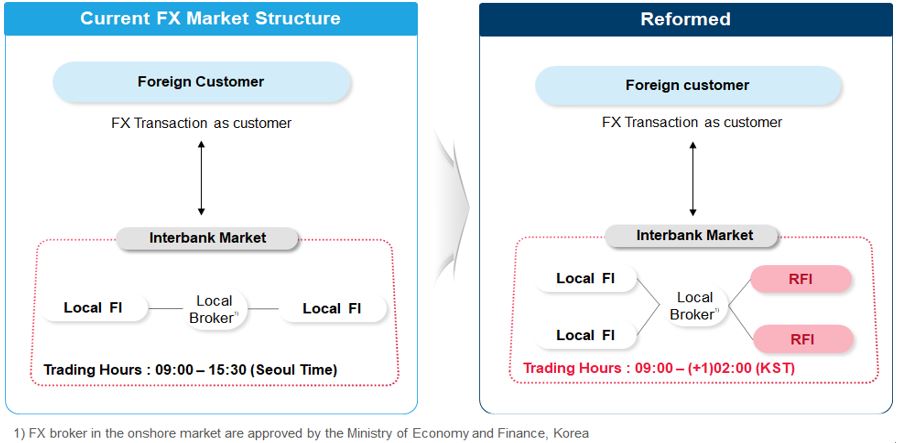

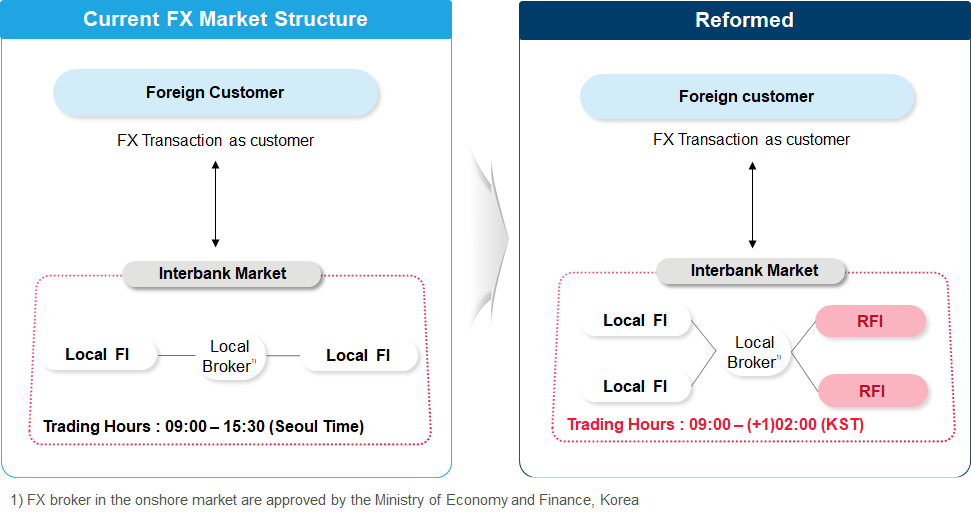

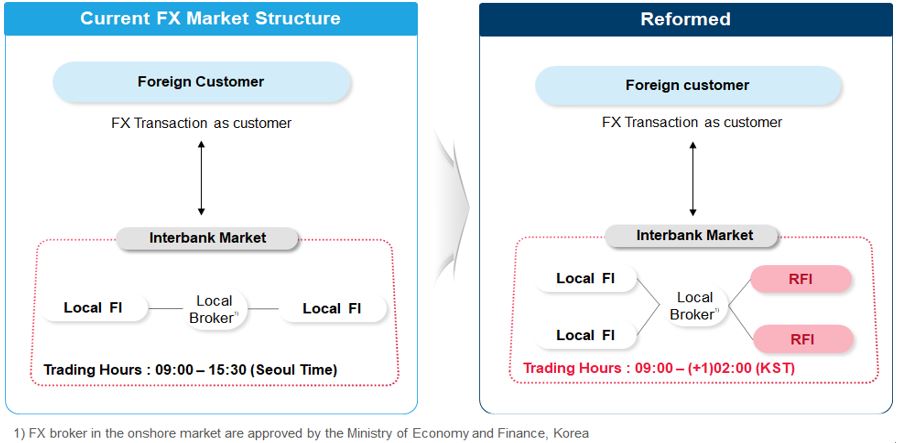

1. Open up the onshore interbank FX market to foreign FIs

Foreign FIs that are not based in Korea (Headquarters of foreign FIs, overseas branches of foreign FIs, and overseas branches of local FIs) will be allowed to directly participate in the onshore interbank FX market, if they obtain registration from the Korean authorities. These institutions will be referred to Registered Foreign Institutions (RFIs).

(Registration eligibility) Foreign FIs that involve in business activities equivalent to those of local FIs[1] (including foreign FIs’ branches in Korea hereinafter) who are currently participating in the onshore interbank FX market will be eligible for registration.

(Registration requirement) Foreign FIs must meet the following requirements in order to be registered as RFIs.

1) Sufficient Liquidity: Foreign FIs must secure a sufficient amount of credit line to conduct transactions with existing participants in the onshore interbank FX market[2].

2) KRW settlement account: Foreign FIs must have their KRW settlement account (Loro/Nostro account) in local bank(s) (including foreign banks’ branches in Korea hereinafter) based on their own entity information (ex: Legal Entity Identifier[3]).

3) Equivalence of foreign regulatory frameworks: The regulatory and supervisory regime of countries where Foreign FIs in question are located must be equivalent to the corresponding Korean framework[4].

4) Commitment: Foreign FIs must submit a commitment letter to ensure compliance with the obligations[5] under Foreign Exchange Transactions Act, implementation of requested tasks of reporting, inspection, supervision and document submission[6], and acceptance of possibility of revoking registration in case of severe breach of obligation.

(Permitted transactions in the onshore interbank FX market) In the onshore interbank FX market, RFIs will be permitted to buy and sell deliverable FX spots and forwards (FX swaps and outright forwards). RFIs should conduct FX transactions only via government-approved local FX broker(s)[7] (including foreign FX brokers’ branches in Korea hereinafter). Whether to allow RFIs to trade other FX derivatives such as Cross Currency Swap (CCS) and Currency Options will be determined later following the implementation of the improvement measures, considering market conditions and demands.

RFIs’ trading and payment process in the interbank market

1) A RFI trades spots and forwards via a government-approved local FX broker.

2) The local FX broker sends a trading statement to the RFI.

3) After checking the trading statement, the RFI asks a local bank where they have a KRW settlement account to make a payment with the statement attached.

4) The local bank compares a total amount written in the statement with the amount RFIs request for payment, and then makes settlement only when the two numbers match.

|

(Permitted transactions facing customers) RFIs are able to trade deliverable FX spots and forwards (FX swaps and outright forwards) facing both onshore customers and offshore customers. In case of RFIs’ transaction facing offshore customers, offshore customers should have their own KRW settlement account in local banks.

2. Extend onshore FX trading hours

(Trading hours) Currently, the onshore interbank FX market is closed at 15:30 (KST). As a first step, its trading hours are extended to 2:00 of the following day (KST), which covers London trading hours. Going forward, the market would be open for trading 24 hours a day, taking into consideration local banks’ preparation and market conditions.

(Benchmark rates) Basic Exchange Rates[8] will be calculated and provided based on current calculation methodology and window from 9:00 to 15:30 (KST) and other benchmark rates[9] would likely be provided if necessary, following market demands.

3. Develop Market infrastructure to be in line with global FX markets.

(Electronic trading) Application Programming Interface (API) that local FX brokers currently provide to local participants will be allowed for connection by RFIs. Also, aggregators[10], widely used FX trading platforms in the global market, will be introduced through legislation. Local and foreign firms willing to provide aggregator services are required to be registered with the Korean authorities. The services are not allowed to be provided between participants in the interbank market.

|

Permitted types of services and assigned duties of aggregator

1) Permitted types of services: The firms registered as aggregator service providers are able to provide aggregator services via chats, Request for Quotation (RFQ) and Disclosed Streaming, in which customers choose their trading counterparties in advance. Non-disclosed streaming approach[11] designed to automatically execute transactions at an optimal price, skipping the process of letting customers choose their trading counterparties in advance, is not allowed.

2) Duty of reporting: The registered firms should report transaction information to the authorities after the transactions are executed.

|

(Third Party FX settlement) Starting from December 16, 2022, non-residents, including foreign FIs, have been authorized to conduct deliverable Korean Won FX transactions facing local banks, in which non-residents do not have their own KRW settlement account. For example, non-residents including foreign FIs can do deliverable Korean Won FX transactions and settlements via a single KRW settlement account in a local representative custodian bank.

(CLS settlement) If a RFI is a Settlement Member (SM) or Third Party (TP) of Continuous Linked Settlement (CLS) banks, the RFI will be able to use CLS’ simultaneous settlement service after opening their own KRW settlement account at CLS Loro/Nostro Agents. Most global financial firms that deal with securities and FX trading business in the domestic market have already had the aforementioned account.

(Reporting system) An additional reporting system will be created for RFIs, considering their difficulties of accessing computer networks run by Bank of Korea for local FIs.

4. Establish cooperative relationship between RFIs and local FIs

(Transaction) When RFIs conduct FX transactions with their branches or headquarters of the same group in Korea, they are allowed to trade deliverable Korean Won directly without going through government-approved local FX broker(s). Regulatory reporting obligation is also exempted for RFIs when RFIs borrow Korean Won from their branches or headquarters of the same group in Korea.

(Administration) Taking into account RFIs’ difficulties in complying with local regulations due to culture and language barriers, branches or headquarters of the same group in Korea will be permitted to act for RFIs in certain requirements such as reporting.

※ RFIs that do not have branches or headquarters in Korea will be permitted to outsource the task of reporting with government-appointed FX market leading banks[12] and be exempt from reporting obligations when they borrow money in Korean Won from these banks.

5. Adjust regulatory system for solid external soundness

(Macroprudential policy) While maintaining the basic framework of the existing macroprudential measures that apply to local FIs, the government will examine the necessity to revamp the measures as RFIs will newly participate in the onshore FX market.

(Safeguards) The government will clarify the definitions of means, procedures, coverage and duration of safeguard measures, which are taken in case of urgent situations, established under the Foreign Exchange Transactions Act.

(Supervision) The government will strengthen a cooperative channel with the supervisory authorities of countries where RFIs are located. In case of RFIs’ violations, including illegal transactions and reporting negligence, Korean authorities will notify the violations to foreign authorities and conduct on-site audits or entrust the auditing task with other relevant authorities if necessary.

Action Plan

The improvement measures aim to be fully implemented from the second half of 2024 at the earliest.

Before full implementation, pilot operation will be conducted for about six months starting from early 2024. During the pilot operation period, the government will examine and refine processes relating to RFIs’ settlement and reporting, and, even if RFIs violates regulations regarding settlement and reporting, they will be allowed to be remedied afterwards. Whether to extend the trading hours during the pilot operation period will be determined in consideration of local banks’ preparation.

Korean government will notify the specifics of pilot operation in due course and inquire foreign FIs’ willingness to participate.

Meanwhile, Korean government will also be holding a number of investor relations event, such as a pan-governmental roadshows, to help foreign investors deepen their understanding of the improvement measures.

[Attachement] Structural Reforms of Korea's FX Market

[1] Banks, comprehensive financial investors, investment traders, investment brokers stipulated under Banking Act (Article 2) and Financial Investment Services and Capital Markets Act (Article 6 and Article 77-2)

[2] Calculation example: Transaction amount of existing participants that offer credit line to RFIs / Total transaction amount in the market ≧ A certain level

[3] A globally verifiable unique identify code given to legal entities (The G20 launched the LEI system in 2011).

[4] In case of the EU, the European Commission (EC) conducts equivalence assessment and the European Securities Markets Authority (ESMA) decides to allow third-country firms to provide services in the EU in consideration of several factors such as whether to sign an agreement with third-country authorities.

[5] The Act prescribed bans on manipulating market price of any foreign exchange, undermining sound transaction order, reporting and confirmation obligation and among others.

[6] Examples: Trading information for the purpose of compiling statistics and supervising, business status, whether to comply with regulations of their own countries.

[7] Spot: Seoul Money Brokerage (SMB) and Korea Money Brokerage (KMB)

Forward : SMB, KMB, KIDB, IPS, Tullett Prebon, GFI Korea, Nittan Capital Korea, Tradition Korea and BGC Capital Markets.

[8] Basic Exchange Rate refers to market average rate (MAR), determined as the transactions volume-weighted average of the rates applied in previous business day’s interbank spot transactions through brokers.

[9] Examples: A fill price at 15:30 (the current closing rate), a fill price at 2 pm, a total market average rate (MAR), etc.

[10] Globally, non-banking firms collect and provide bank-specific ask prices in real time as well as help customers execute and confirm transactions.

[11] Under this approach, banks continuously offer ask prices to customers and transactions are automatically made at an optimal price without the process of customers’ comparing the prices by bank, causing business overlap with local FX brokers.

[12] The government annually selects market-leading banks based on their contribution to market liquidity and provide incentives as a reward. The list of leading banks for 2023 are as follows: Hana Bank, Shinhan Bank, Woori Bank, KDB Bank, JPMorgan Korea, and Credit-Agricole Korea.